If you need a quick and easy loan, small loan apps can help a lot. In this article, we will discuss the 10 best small loan apps that allow you to get money fast with minimal paperwork and easy payments. Whether you need money for personal items, emergencies, or your business, apps like Lendbox, FlexPay, PaySense, and Zetloan make it easy to get a loan. Each app is different, so you can choose the one that suits your needs. Below are 10 Best small loan app list , you can choose only after reading the process, advantages and disadvantages of these small loan app.

People take small loans when they want money on urgent basis. Many people in India don’t have sufficient savings. For example , if there’s an emergency, like a medical emergency, education purpose, while paying fees of exam or colleges , a small loan can assist. People also use small loans to buy things they want. Sometimes, people take small loans to repay other money owed, so that they don’t ought to pay quite a few excessive hobby costs.

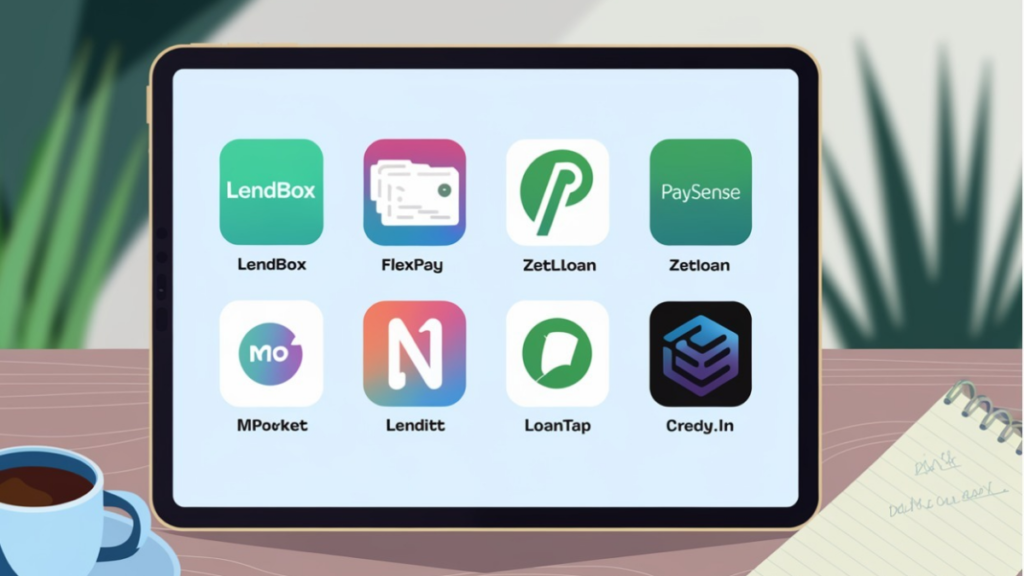

Below Is The List Of 9 Best Small Loan App

Here’s an in-depth guide to the 9 small loan apps you’ve mentioned, covering their loan amounts, loan duration, documents required, advantages, and disadvantages, along with their country of operation:

1. Lendbox

Loan Amount:

- Lendbox offers personal loans starting from ₹10,000 to ₹5,00,000.

Loan Duration:

- Loan tenure ranges from 3 months to 36 months.

Documents Required:

- Aadhar card

- PAN card

- Bank statement (3-6 months)

- Proof of income (Salary slips or ITR)

- Address proof (Utility bills, etc.)

Advantages:

- Flexible loan tenure (up to 36 months).

- Competitive interest rates.

- User-friendly mobile app interface.

- Quick approval and disbursal of loans.

- Suitable for both salaried and self-employed individuals.

Disadvantages:

- The loan approval process may take longer than expected due to verification.

- High processing fee for some loans.

- Only available for individuals with a good credit score.

2. FlexPay

Loan Amount:

- FlexPay offers loans ranging from ₹1,000 to ₹5,00,000.

Loan Duration:

- Loan tenure ranges from 3 months to 24 months.

Documents Required:

- PAN card

- Aadhar card

- Bank statement (3-6 months)

- Salary slip (if employed) or business proof (if self-employed)

Advantages:

- Flexible repayment options (EMI or weekly repayment).

- Loans can be sanctioned very quickly.

- Minimal documentation.

- Can be used for both personal and business expenses.

Disadvantages:

- The loan amount depends on the applicant’s credit score and income.

- High-interest rates for some users.

- Loan eligibility criteria can be stringent.

3. PaySense

Loan Amount:

- Loans from ₹5,000 to ₹5,00,000.

Loan Duration:

- Loan tenure ranges from 3 months to 36 months.

Documents Required:

- PAN card

- Aadhar card

- Bank statements (6 months)

- Address proof (Electricity or water bill)

- Income proof (Salary slip or ITR)

Advantages:

- Instant disbursement of loans.

- Competitive interest rates based on user’s credit score.

- Offers personal loans with no collateral.

- Easy application process through the app.

- Minimal documentation required.

Disadvantages:

- Requires good credit history to get approved.

- Processing fees can be high in some cases.

- Late payment fees are charged on delayed repayments.

4. Zetloan

Loan Amount:

- Loan amounts range from ₹2,000 to ₹50,000.

Loan Duration:

- Loan tenure ranges from 7 days to 3 months.

Documents Required:

- Aadhar card

- PAN card

- Bank account details

Advantages:

- Instant loan approval and disbursal within 24 hours.

- Low-interest rates for small loan amounts.

- Minimal documentation.

- Flexible loan tenures.

Disadvantages:

- Loan amounts are relatively low compared to other apps.

- Available only for individuals with a decent credit score.

- Not suitable for larger loan requirements.

5. KreditBee

Loan Amount:

- Kreditbee offers loans ranging from ₹1,000 to ₹1,50,000.

Loan Duration:

- Loan tenure ranges from 3 months to 15 months.

Documents Required:

- Aadhar card

- PAN card

- Bank statement (3 months)

- Proof of income (Salary slip or bank transactions)

Advantages:

- Fast loan approval and disbursal.

- Flexible repayment options (EMI or lump sum).

- Minimal documentation required.

- Available to both salaried and self-employed individuals.

Disadvantages:

- Available only to individuals with a good credit score.

- Loan amounts may be smaller compared to other apps.

- High-interest rates for certain users.

6. NoBroker

Loan Amount:

- NoBroker provides personal loans up to ₹5,00,000.

Loan Duration:

- Loan tenure ranges from 6 months to 36 months.

Documents Required:

- Aadhar card

- PAN card

- Bank statement (3-6 months)

- Proof of employment or income

Advantages:

- NoBroker is primarily known for real estate, but also offers loan options through their partners.

- No property mortgage required for a loan.

- Offers instant loan approval.

- Competitive interest rates for loan amounts.

Disadvantages:

- Loan eligibility is dependent on the applicant’s credit score and income level.

- Limited to users in specific cities.

- Processing fees are relatively high.

7. mPokket

Loan Amount:

- mPokket offers loans ranging from ₹500 to ₹20,000.

Loan Duration:

- Loan tenure is typically 7 days to 3 months.

Documents Required:

- Aadhar card

- PAN card

- Bank details

Advantages:

- Extremely fast loan approval and disbursal (usually within minutes).

- Ideal for students and young professionals.

- No credit score check for small loans.

- Flexible repayment options.

Disadvantages:

- Loan amounts are small (₹500 to ₹20,000).

- High-interest rates.

- Short loan tenure may not suit all users.

- Available only in select cities.

8. Lenditt

Loan Amount:

- Lenditt offers loans starting from ₹10,000 to ₹2,00,000.

Loan Duration:

- Loan tenure ranges from 6 months to 24 months.

Documents Required:

- PAN card

- Aadhar card

- Bank statement (3-6 months)

- Address proof

- Salary slip or business proof

Advantages:

- Quick and easy loan application.

- Minimal documentation required.

- Available to both salaried and self-employed individuals.

- Competitive interest rates.

Disadvantages:

- Processing fees can be high.

- Loan approval time may vary.

- High-interest rates for users with a lower credit score.

9. LoanTap

Loan Amount:

- Loan amounts range from ₹50,000 to ₹10,00,000.

Loan Duration:

- Loan tenure varies from 12 months to 60 months (5 years).

Documents Required:

- PAN card

- Aadhar card

- Bank statements (6 months)

- Income proof (Salary slip or ITR)

- Proof of address

Advantages:

- Flexible loan tenure options.

- Offers personal loans, business loans, and home loans.

- Minimal documentation.

- Quick loan approval process.

Disadvantages:

- Higher interest rates for smaller loan amounts.

- Available only to individuals with a good credit score.

- Processing fee may apply.

10. CREDY.in

Loan Amount:

- CREDY offers loans ranging from ₹5,000 to ₹5,00,000.

Loan Duration:

- Loan tenure ranges from 3 months to 36 months.

Documents Required:

- PAN card

- Aadhar card

- Bank account details

- Proof of income (Salary slip or ITR)

Advantages:

- Provides loans with minimal documentation.

- Loan approval process is fast and seamless.

- Flexible repayment options.

- Available for individuals with a decent credit score.

Disadvantages:

- High-interest rates for small loans.

- Processing fee may be applicable.

- Only available to residents of certain cities in India.

What should one check before using a loan app?

While using small loan app , please check advantages and disadvantages of that app in details. Please check documents and read reviews before taking loan app These small loan apps used primarily to individuals in India, with each offering unique features and loan options. While apps like Lendbox and FlexPay offer larger loan amounts, others like mPokket focus on small, fast loans ideal for students and professionals. The primary documents required across these apps are PAN card, Aadhar card, bank statements, and proof of income.

Advantages of using small loan apps include quick approval, minimal documentation, and flexible loan terms, while disadvantages often include high interest rates, processing fees, and varying eligibility criteria. Depending on your specific need whether it’s a small loan, fast disbursement, or longer repayment term there’s an app suited to your requirements.

Why People Prefer to Take Small Loans ?

To make money quickly and easily

The best thing about small loans is that you can get money quickly. Support smaller applications or multiple lenders for your funding in a day or two. This really helps when you need money quickly in an emergency.

Easy amounts and payments

Small loans give you any loan amount or slightly more. Also, repaying the loan can be easier. You can choose how long you want to repay the loan, making it comfortable for your budget.

Few papers are produced

Applying for a small loan is very easy. You don’t need many pages. In most cases, all you need is your ID, bank information and proof of income. This makes the whole process faster and easier.

Bail is not required

Most small loans don’t require you to pay anything as security, like a house or a car. Failure to pay means you will not lose anything of value. For people without great resources, there is no risk.

It can improve your credit score

Taking out a small loan and paying it back on time can help improve your credit score. Lenders can report your payments to credit bureaus, which helps you maintain a good credit history.

It’s easy to give back

Small loans offer a variety of payment options. You can pay monthly, weekly, or in one lump sum based on what works best for you. This makes it easier to make payments without putting too much strain on your finances.

It helps with financial flexibility

Small loans provide extra financial support when you need it. They make managing your money easier, especially in tough times. A small loan allows you to meet immediate needs without worrying too much about your finances.

FAQs

1. Why do I Need the Loan?

Understanding the exact reason for taking out a loan will help you assess if it’s truly necessary. Is it for an emergency, a planned expense, or something you could delay?

2. How much money do I need?

Only borrow what you actually need. Borrowing more than required can lead to higher interest payments and unnecessary debt.

3. Are there any hidden fees or charges?

Ask the lender about any processing fees, late payment fees, or prepayment penalties. Hidden fees can increase the total cost of the loan.

777betcasinologin is pretty straightforward. Login was easy, and they’ve got a decent selection of games. Worth checking out if you’re looking for something new, visit 777betcasinologin.

Playing on 722jogobet has been a game changer! Good selection of games, safe & quick transfer. Definitely would suggest hitting up 722jogobet for anyone looking for a new casino online.

Alright folks, let me tell you about 622betlogin. I’ve been using it for a while now, and the login process is super smooth. No crazy hoops to jump through, just straight to the action So, if you’re looking for a hassle-free experience, give this a try: 622betlogin